As a New Canadian you may bring welcomed business expertise with you to Canada, or you may choose to use your talents to start a business for the first time. In either case, the Canadian business context is likely to be somewhat different from what you experienced previously. There is a lot to know about:

As a New Canadian you may bring welcomed business expertise with you to Canada, or you may choose to use your talents to start a business for the first time. In either case, the Canadian business context is likely to be somewhat different from what you experienced previously. There is a lot to know about:

- Business to business (B2B) practices

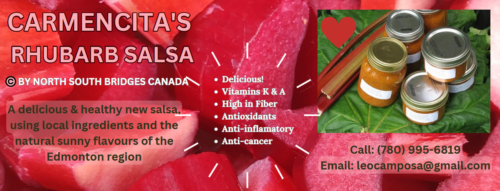

- Consumer markets – demographics & psychographics

- Business banking & financing

- Advertising in the Canadian context

- Corporate taxes

- Incorporation

- Consumer protection laws

- Employee protection laws

- Environmental protection laws

- Etc.

Wayfinders Business Co-operative is developing an orientation to doing business in Canada, complete with links to relevant websites.

We also welcome your contributions to our Wayfinders community by adding your questions, comments and suggestions for others on this community of interest.

Canadian Context

Running a business in Canada takes the same kinds of skills, talents and attitudes that are needed anywhere. But every country is different and Canada is no exception. We have different laws, practices and customs. For example we have our own laws protecting labour, consumers and the environment. We have our own banking, investment and insurance laws and practices.

Depending on your plans and business model, you may need to incorporate (provincial) and get a business permit and license (municipal).

Canada is known around the world as a safe place to do business. Government corruption is almost non-existent. You need not be concerned that you will be asked for a bribe when you do business with an level of government. There are several kinds of legal business contracts to help ensure honest business transactions. There are civil litigation laws and courts to deal with infractions of those agreements. Depending on the kind of business you are proposing, you may need to find a lawyer to help with incorporation or to draft legal agreements.

The Canadian marketplace is an interesting mosaic, firmly rooted in natural resources, agriculture and food production, value-added processing, construction and services. The Government of Canada makes market data available for anyone. However, you may need professional help in understanding the statistics so you can create a meaningful and viable marketing plan. Fortunately, Wayfinders has members who are marketing professionals.

Businesses need money. There are several ways to raise funds in Canada. You will need to make a good business case for any investors and then implement the plan. Like financing in most countries, it usually begins with a little help from family and friends. That may take the form of loans or shares in the company. Bank loans may be available, but banks are cautious when investing depositor’s money in ventures that may be risky. They want to see a business plan, your cash investment, collateral and especially your ‘character’. Other forms of investment may be available including bonds, angel investment and even venture capital.

Canada and Alberta Banking (ATB Financial)

Canadian Insurance (The Cooperators)

International Trade and Investment

The Alberta Context

Most laws fall under provincial jurisdiction. The following links will take you to Government of Alberta websites for more information: